Loan Eligibility Calculator

*Assumes 50% FOIR

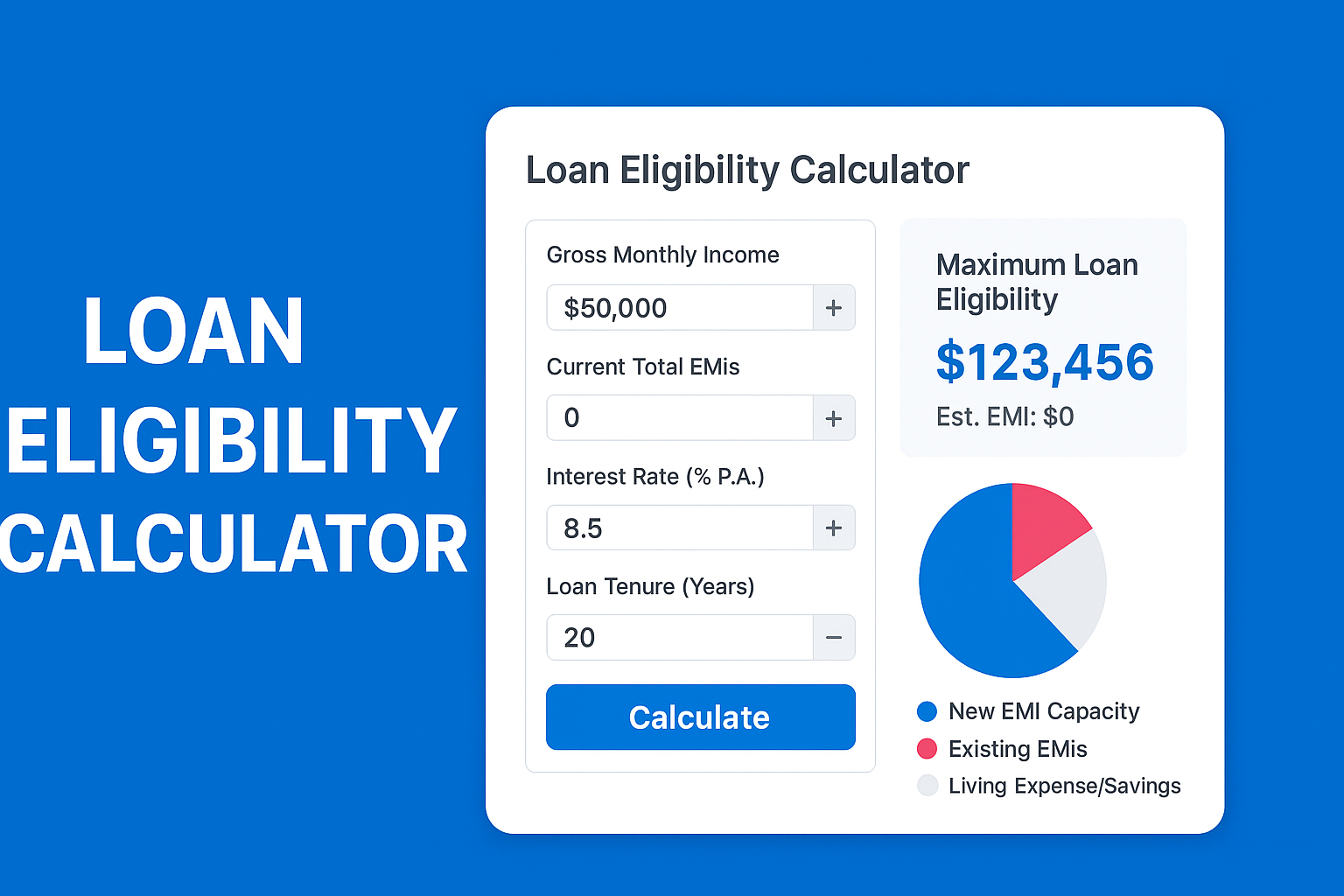

| Breakdown | Amount |

|---|---|

| ● New EMI Capacity | 0 |

| ● Existing EMIs | 0 |

| ● Living/Savings (50%) | 0 |

Loan Eligibility Calculator Online – Check Your Maximum Loan Amount Instantly

A Loan Eligibility Calculator is an essential financial planning tool that helps individuals accurately determine how much loan amount they can avail based on their monthly income, existing EMIs, interest rate, and loan tenure. Whether you are planning to apply for a home loan, personal loan, education loan, or car loan, knowing your eligibility beforehand saves time, improves approval chances, and prevents financial stress.

Our advanced Loan Eligibility Calculator online is designed with real-world banking logic such as FOIR (Fixed Obligation to Income Ratio) and provides instant results along with an interactive chart and EMI breakdown.

What Is a Loan Eligibility Calculator?

A loan eligibility calculator is an online financial tool that estimates the maximum loan amount a lender may offer you. Banks and NBFCs evaluate eligibility based on:

- Gross monthly income

- Existing financial obligations (current EMIs)

- Interest rate

- Loan tenure

- FOIR percentage (generally 40%–50%)

This calculator uses a 50% FOIR standard, which is widely accepted by Indian banks and financial institutions.

How Does the Loan Eligibility Calculator Work?

The calculator applies a structured formula that financial institutions use internally.

Step-by-Step Calculation Logic:

- Maximum EMI Allowed

50% of your monthly income is considered safe for total EMI payments. - Available EMI Capacity

Existing EMIs are deducted from the allowed EMI limit. - Loan Amount Calculation

Using the standard EMI formula and interest rate, the calculator computes the maximum loan principal you are eligible for. - Visual Representation

A doughnut chart displays:

- New EMI capacity

- Existing EMIs

- Living expenses and savings

Key Features of Our Loan Eligibility Calculator

✅ Instant Loan Eligibility Check

✅ Supports Home Loan, Personal Loan & Car Loan Planning

✅ Interactive + / − Controls for Easy Input

✅ Real-Time EMI & Loan Amount Calculation

✅ Visual Chart for Income Distribution

✅ Mobile-Friendly & Fast Loading

✅ No Login or Registration Required

This makes it one of the best loan eligibility calculators online for both salaried and self-employed individuals.

Inputs Required to Calculate Loan Eligibility

To use the calculator effectively, enter the following details:

- 1. Gross Monthly Income

- Your total monthly income before deductions.

- 2. Existing EMIs

- All current loan EMIs including credit cards, personal loans, or vehicle loans.

- 3. Interest Rate

- Annual interest rate offered by the lender (in %).

- 4. Loan Tenure

- Loan duration in years (typically 1–30 years).

What Results Does the Calculator Show?

After calculation, you instantly get:

- Maximum Loan Eligibility Amount

- Estimated Monthly EMI

- Income Distribution Chart

- Breakdown of EMIs, Living Expenses & Savings

This helps you understand whether the loan is financially comfortable and sustainable.

Why Checking Loan Eligibility Is Important

✔ Avoids loan rejection

✔ Helps choose the right loan amount

✔ Prevents over-borrowing

✔ Improves credit planning

✔ Saves processing time

✔ Enhances negotiation power with banks

A pre-checked eligibility gives you confidence before applying for any loan.

Who Should Use This Loan Eligibility Calculator?

- Salaried professionals

- Business owners & freelancers

- First-time home buyers

- Car loan applicants

- Personal loan seekers

- Financial advisors & planners

If you’re planning any type of loan, this tool is must-use.

Loan Eligibility vs EMI Calculator – What’s the Difference?

| Feature | Loan Eligibility Calculator | EMI Calculator |

|---|---|---|

| Purpose | Finds max loan amount | Finds EMI amount |

| Based on Income | Yes | No |

| FOIR Logic | Yes | No |

| Best for | Loan planning | EMI comparison |

Benefits of Using Our Online Loan Eligibility Calculator

- 100% Free

- Accurate & Bank-Grade Logic

- Secure – No Data Storage

- Works on All Devices

- Fast & Lightweight

Frequently Asked Questions (FAQs) : currency converter

- Q1-Is loan eligibility the same for all banks?

- No. Banks may use different FOIR limits, interest rates, and tenure caps.

- Q2-Does CIBIL score affect loan eligibility?

- Yes. A higher credit score improves approval chances and loan amount.

- Q3-Can I increase my loan eligibility?

- Yes, by:

- Increasing income

- Reducing existing EMIs

- Choosing longer tenure

- Applying jointly

- Q4-Is this calculator accurate?

- Yes. It uses standard EMI and FOIR formulas commonly used by lenders.

Conclusion: Loan Eligibility Calculator

Before applying for any loan, it is crucial to know your true borrowing capacity. This Loan Eligibility Calculator online gives you a clear, instant, and realistic estimate of how much loan you can afford—helping you make smarter financial decisions.

👉 Use the calculator above to check your loan eligibility instantly and plan your future with confidence.

Search Keywords

loan eligibility calculator, loan eligibility check online, home loan eligibility calculator, personal loan eligibility calculator, loan amount calculator, emi eligibility calculator, income based loan eligibility, foir calculator, maximum loan amount calculator, loan planning calculator

Our Other Online Calculators

You Can Also Check Out Our Other Free Online Tools Like Age Calculator, Percentage Calculator, Body Fat Calculator, And More.”

Are You Searching For A Government Job In India

You Can Also Check Our Job Alert, Admit Card, And Sarkari Result Updates On ExamJobAlert.com – Your Trusted Source For Government Job Notifications.