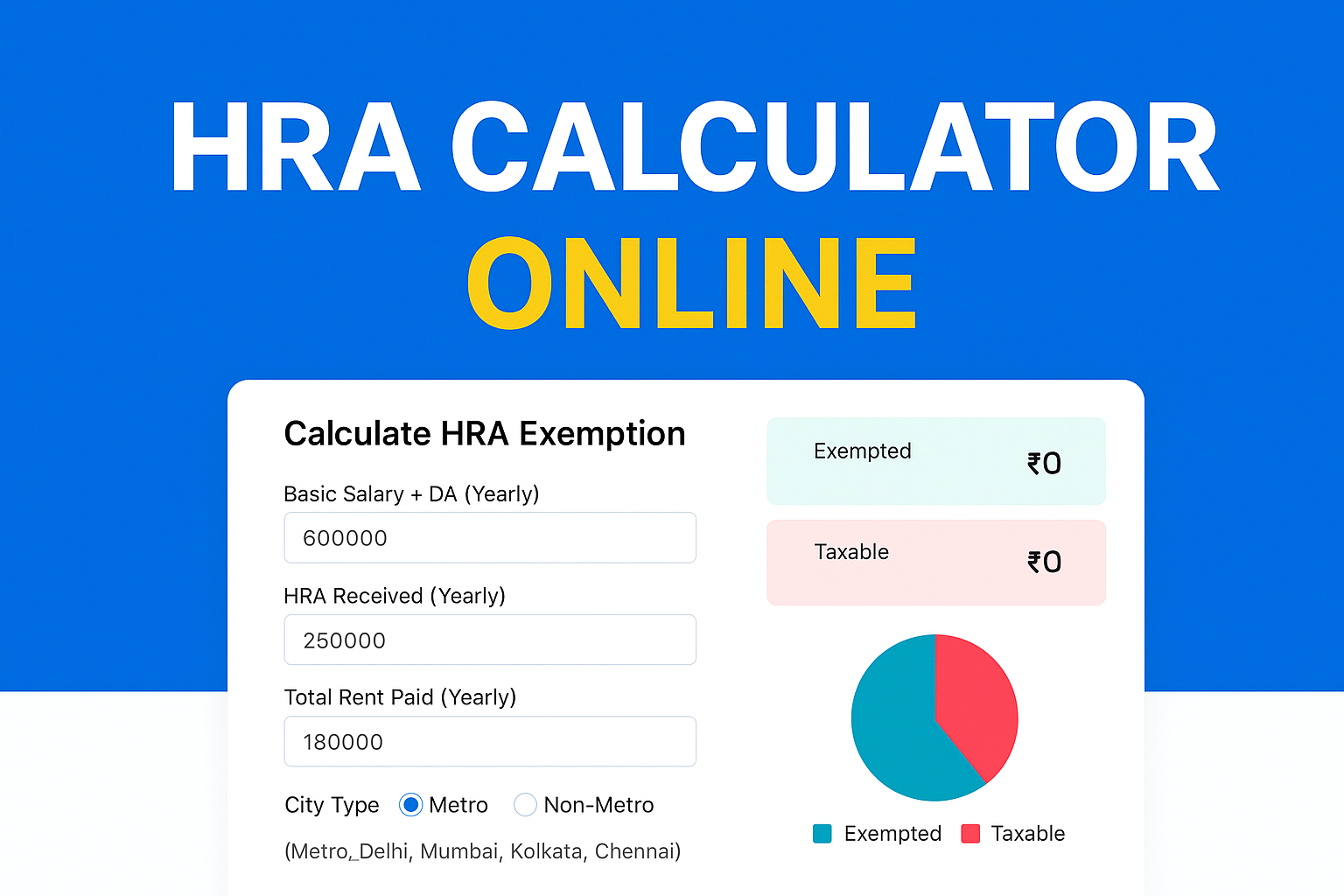

Calculate HRA Exemption

Exempted

Taxable

Exemption is Minimum of:

HRA Calculator – Calculate House Rent Allowance Exemption Online (India)

House Rent Allowance (HRA) is one of the most important salary components for salaried individuals in India. If you live in a rented house, you can claim HRA exemption under Section 10(13A) of the Income Tax Act, which helps reduce your taxable income significantly.

Our HRA Calculator lets you calculate HRA exemption and taxable HRA instantly, based on the latest income tax rules.

What is HRA (House Rent Allowance)?

HRA is a salary component paid by employers to employees to meet rental accommodation expenses. A part of HRA is tax-exempt, while the remaining amount becomes taxable, depending on your salary, rent paid, and city of residence.

How the HRA Calculator Works

This online HRA exemption calculator computes your eligible exemption by comparing three values and selecting the minimum, as prescribed by income tax rules:

- Actual HRA received from employer

- Rent paid minus 10% of Basic Salary + DA

- 50% of Basic Salary (Metro cities) or 40% of Basic Salary (Non-Metro cities)

The lowest of the above three amounts is treated as HRA Exempt, and the remaining portion of HRA becomes Taxable HRA.

Inputs Required in the HRA Calculator

To calculate your HRA exemption accurately, you need to enter:

- Basic Salary + Dearness Allowance (Yearly)

- HRA Received (Yearly)

- Total Rent Paid (Yearly)

- City Type (Metro or Non-Metro)

- Metro cities include Delhi, Mumbai, Kolkata, and Chennai.

Key Features of This HRA Calculator

- ✅ Accurate calculation as per Income Tax Act, India

- ✅ Separate display of Exempt HRA and Taxable HRA

- ✅ Detailed HRA exemption breakdown

- ✅ Visual doughnut chart for better understanding

- ✅ Mobile-friendly, fast, and easy to use

- ✅ No registration or login required

Why Use an Online HRA Calculator?

Using an online HRA calculator helps you:

- Plan your income tax savings efficiently

- Understand how rent and city type affect your exemption

- Avoid manual calculation errors

- Estimate your taxable salary before filing returns

This tool is especially useful during tax planning, salary negotiations, and ITR filing.

Who Can Claim HRA Exemption?

You can claim HRA exemption if:

- You are a salaried employee

- You receive HRA as part of your salary

- You live in a rented accommodation

- You pay rent and can provide proof if required

- Self-employed individuals cannot claim HRA but may claim deduction under Section 80GG instead.

Important Notes

- Rent receipts may be required by employers or during tax assessment

- PAN of the landlord is mandatory if annual rent exceeds ₹1,00,000

- HRA exemption is available only under the old tax regime

Frequently Asked Questions (FAQs) – HRA Calculator

- 1. What is HRA and why is it important for tax saving?

HRA (House Rent Allowance) is a part of your salary paid to cover rental expenses. A portion of HRA is exempt from income tax under Section 10(13A), which helps reduce your overall taxable income. - 2. How is HRA exemption calculated?

HRA exemption is the minimum of the following three values: - Actual HRA received

- Rent paid minus 10% of Basic Salary + DA

- 50% of Basic Salary (Metro cities) or 40% (Non-Metro cities)

- 3. Which cities are considered Metro for HRA calculation?

For HRA exemption, Delhi, Mumbai, Kolkata, and Chennai are treated as Metro cities. - 4. Can I claim HRA if I live in my own house?

No. HRA exemption is available only if you live in a rented property and pay rent. - 5. Is HRA exemption available under the new tax regime?

No. HRA exemption can be claimed only under the old tax regime. - 6. Do I need rent receipts to claim HRA?

Yes. Employers usually require rent receipts as proof. During income tax assessment, rent proof may also be asked. - 7. Is landlord PAN required for HRA claim?

Yes. If your annual rent exceeds ₹1,00,000, you must provide your landlord’s PAN. - 8. Can self-employed individuals claim HRA exemption?

No. Self-employed individuals cannot claim HRA, but they may claim deduction under Section 80GG if eligible. - 9. What happens if rent paid is less than 10% of basic salary?

In such cases, the value of (Rent paid – 10% of Basic) becomes zero, which may reduce or eliminate HRA exemption. - 10. Is Dearness Allowance (DA) included in HRA calculation?

Yes. DA is included only if it forms part of retirement benefits, otherwise only Basic Salary is considered. - 11. Can I claim HRA and home loan tax benefits together?

Yes. You can claim HRA exemption and home loan deductions simultaneously if you meet the respective conditions. - 12. How accurate is this HRA Calculator?

This calculator follows the latest Indian income tax rules and provides accurate results based on the inputs you enter. - 13. Is this HRA Calculator free to use?

Yes. This is a 100% free online HRA calculator with no registration or personal data required. - 14. Should HRA be calculated monthly or yearly?

HRA exemption can be calculated monthly or yearly, but yearly calculation gives a clearer view for tax planning. - 15. Why should I use an online HRA Calculator instead of manual calculation?

An online HRA calculator saves time, avoids errors, and instantly shows exempt and taxable HRA, making tax planning easier.

Conclusion: Calculate Your HRA Exemption Now

Use this HRA Calculator online to instantly know how much of your House Rent Allowance is tax-free and how much is taxable. Proper HRA calculation can help you save a significant amount on income tax every year.

👉 Try the HRA Calculator above and plan your taxes smarter!

Search Keywords

hra calculator, house rent allowance calculator, hra exemption calculator, calculate hra exemption, hra tax exemption, hra calculation online, hra taxable amount, hra income tax calculator, hra old tax regime, metro non metro hra

Our Other Online Calculators

You Can Also Check Out Our Other Free Online Tools Like Age Calculator, Percentage Calculator, Body Fat Calculator, And More.”

Are You Searching For A Government Job In India

You Can Also Check Our Job Alert, Admit Card, And Sarkari Result Updates On ExamJobAlert.com – Your Trusted Source For Government Job Notifications.